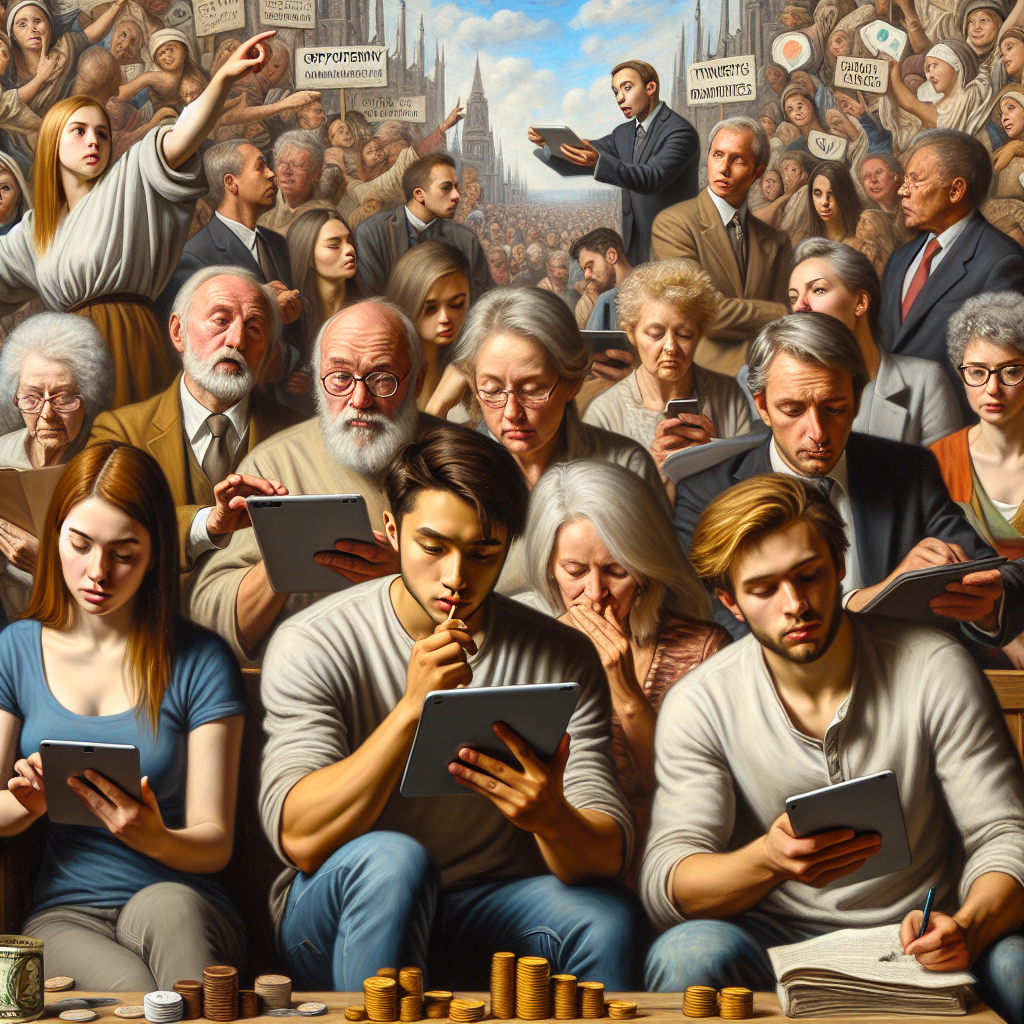

How Gen Z’s Crypto Bets, ESG Hustles, and Side Gigs Are Rewriting Capitalism

👋 Welcome to the Battlefield

Let’s face it: Boomers hold 50% of America’s wealth—$78 trillion in stocks, real estate, and pensions. Meanwhile, Gen Z is stuck paying off student loans and battling rent hikes. But here’s the twist: Zoomers aren’t begging for scraps. They’re building wealth on their own terms—crypto, green energy ETFs, and side gigs—while Boomers cling to a playbook written in the 1980s.

If your family dinners involve debates about “safe bonds” vs. “risky Bitcoin,” you’re already part of this war.

In this 3-part series, we’re dissecting the seismic shift in how money is made, managed, and fought over. Part 1? Let’s unpack why Gen Z is torching the old rules—and what it means for your future.

💼 Gen Z’s Rulebook: Wealth Building 2.0

1. Crypto Over 401(k)s: A Calculated Rebellion

The Cold Hard Facts:

- 42% of Gen Z owns crypto, compared to just 11% with retirement accounts (YouGov 2025).

- Why? Millennials watched their parents’ 401(k)s tank in 2008. Gen Z learned the lesson: “Control your own money.”

Meet Carlos, 22, a Miami barista who moonlights as a crypto trader:

“My dad’s 401(k) grew 3% last year. My Solana? Up 150%. Why would I trust a system that failed him?”

The Crypto Advantage:

- 24/7 markets: Trade Bitcoin at 3 AM in pajamas—no Wall Street brokers needed.

- Low barriers: Start with $5 on Coinbase vs. $1,000 minimums for mutual funds.

- Inflation hedge: 63% of Gen Z views crypto as protection against rising costs (Forbes 2025).

But here’s the catch: Crypto’s volatile. Bitcoin swung ±25% last quarter. Still, Gen Z’s betting long-term—and winning.

2. ESG Investing: Profit with a Side of Planet

Fact Check:

- 40% of Gen Z portfolios include clean energy ETFs or vegan startups (Morgan Stanley 2025).

- Solar ETFs like ICLN surged 78% since 2023, while oil stocks lagged.

Meet Jake, 19, a community college student turned green investor:

“I put $1,000 into a solar ETF last year. Now it’s $1,120. My grandpa’s Exxon stock? Down 12%.”

Why ESG Works:

- Government cash: The U.S. is funneling $12 trillion into green energy by 2030.

- Consumer shifts: Plant-based meat sales jumped 30% as beef prices soared.

- Transparency: Apps like Yahoo Finance now grade companies on ESG metrics. Gen Z avoids anything below a “B.”

Is ESG just a trend? Tell that to the Gen Zers quietly retiring at 40.

3. Side Hustles: The New Retirement Plan

By the Numbers:

- 70% of Gen Z has a side hustle (Upwork 2025).

- Top earners: AI prompt engineers ($200/hour), TikTok creators, and crypto stakers.

Meet Priya, 24, a graphic designer with a secret empire:

- Day job: $45k/year designing logos.

- Side gig: Sells AI-generated art on Etsy ($1,200/month).

- Night hustle: Stakes Solana for 6.5% annual returns ($600/month).

Gen Z’s Playbook:

- Diversify income: Never rely on one paycheck.

- Automate savings: Apps like Acorns invest spare change.

- Retire early: Build dividend portfolios, not pensions.

“Why wait for Social Security when you can create your safety net?”

🤯 Why Wall Street’s Panicking

Fact Check:

- 401(k) fees: The average plan charges 0.49% annually, but some hit 1.5%—costing workers 28% of potential earnings over 30 years (Yale University).

- Speed gap: Robinhood executes trades in 0.05 seconds; Boomer-era brokers took minutes.

Reddit’s r/Fire community sums it up:

“Boomer advisors are like Blockbuster—nostalgic but irrelevant.”

Gen Z’s response? Cut out middlemen. Use AI tools. Keep profits.

🚀 Your Turn: Join the Rebellion

Step 1: Start Small with Crypto

- Coinbase Round-Ups: Invest leftover coffee money into Bitcoin automatically.

- Staking 101: Park Cardano coins to earn 5% APR (vs. banks’ 0.01%).

Step 2: Bet on Green (and Win)

- Betterment ESG Portfolios: Invest $10 in wind/solar stocks.

- Vegan ETF (VEGN): Up 18% this year as Beyond Meat dominates fast food.

Step 3: Monetize Everything

- Twitch + Shopify: Stream gameplay while selling merch to fans.

- Fiverr Pro: Charge $200/hour for AI prompt engineering.

💡 The Takeaway: Rewrite the Rules

Boomers built wealth on slow, steady, and centralized. Gen Z’s playing fast, decentralized, and self-made.

Who’s right? History will decide. But here’s the truth: You don’t need Wall Street’s permission to win.

Coming in Part 2:

“The $78 Trillion Shakeup: How Boomer Wealth Transfers Will Crush—or Create—Your Future.”

Sources

- YouGov Gen Z Wealth Report 2025

- Morgan Stanley Green Energy Outlook

- Yale University 401(k) Fee Analysis

- Reddit r/FIRE Community Survey

SEO Keywords

Generational wealth war, Gen Z crypto strategies, ESG investing trends, side hustle economy

💬 Let’s Debate:

- Crypto or 401(k)? Pick your side.

- What’s your wildest side hustle? (We’ve heard it all.)

Comment below—we’ll feature the boldest takes in Part 2!